This is a developing article. Comments are welcome.

Should you invest during the Wuhan virus outbreak?

Much comparisons have been made for Wuhan virus against SARS, since the nature of the emergency is largely similar.

To determine if the outbreak of the Wuhan virus presents an opportunity for investment,

I overlay the impact of SARS and MERS against stock index performance.

Although historical events cannot predict the future, it is useful to draw lessons from the past.

The results are shown below.

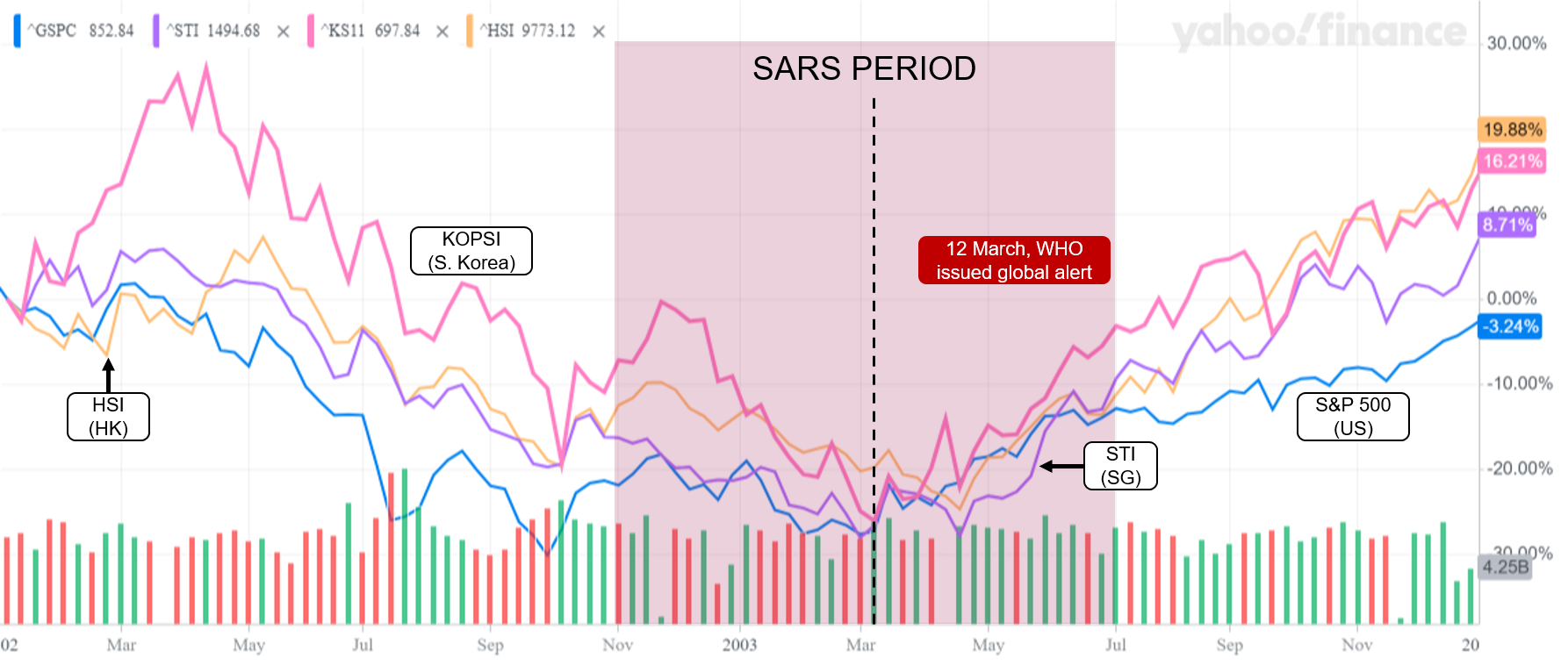

How did stocks perform during SARS?

Severe acute respiratory syndrome coronavirus or SARS-CoV outbreak occurs between November 2002 and July 2003 with majority of the cases in China mainland and Hong Kong.

Globally, over 8,000 people were sickened with 800 deaths.

In Singapore, SARS infected 238 people and killed 33 of them.

- Decline of ~10

- Prior to SARS, the Dow Jones Industrial Average, NASDAQ and S&P 500 had lost ~26

- Crash speculated to be due to unusually high stock valuations, bankruptcy of many internet companies (Pets.com), infamous accounting scandals (Enron, WorldCom) and September 11 attacks.

- Rapid recovery of the indexes, ending the year higher than they started, with the exception of S&P 500.

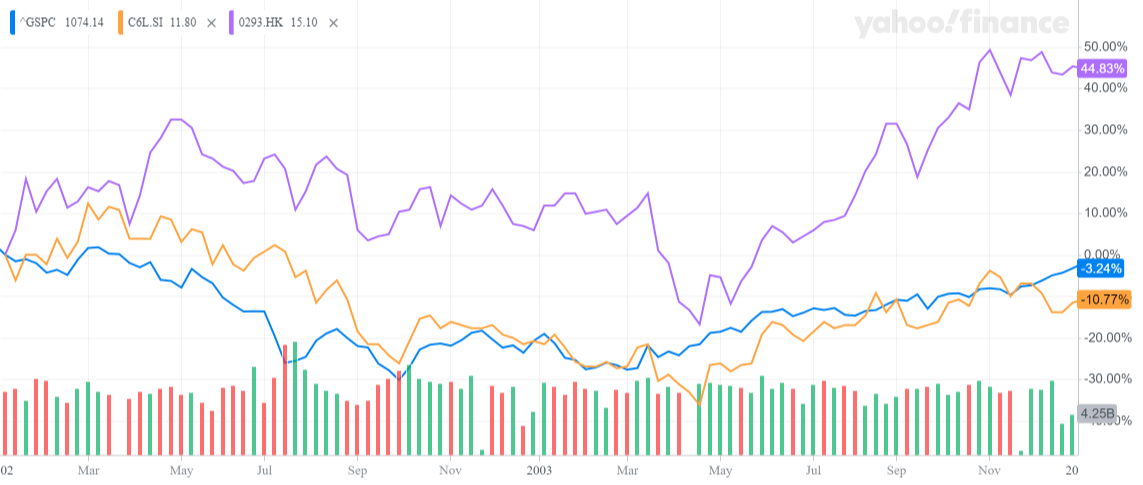

How did airline stocks perform then?

- However, airlines did take substantial beating for their stocks.

- SIA’s stock price trend with S&P 500 while Cathy Pacific’s stock drop by more than 20

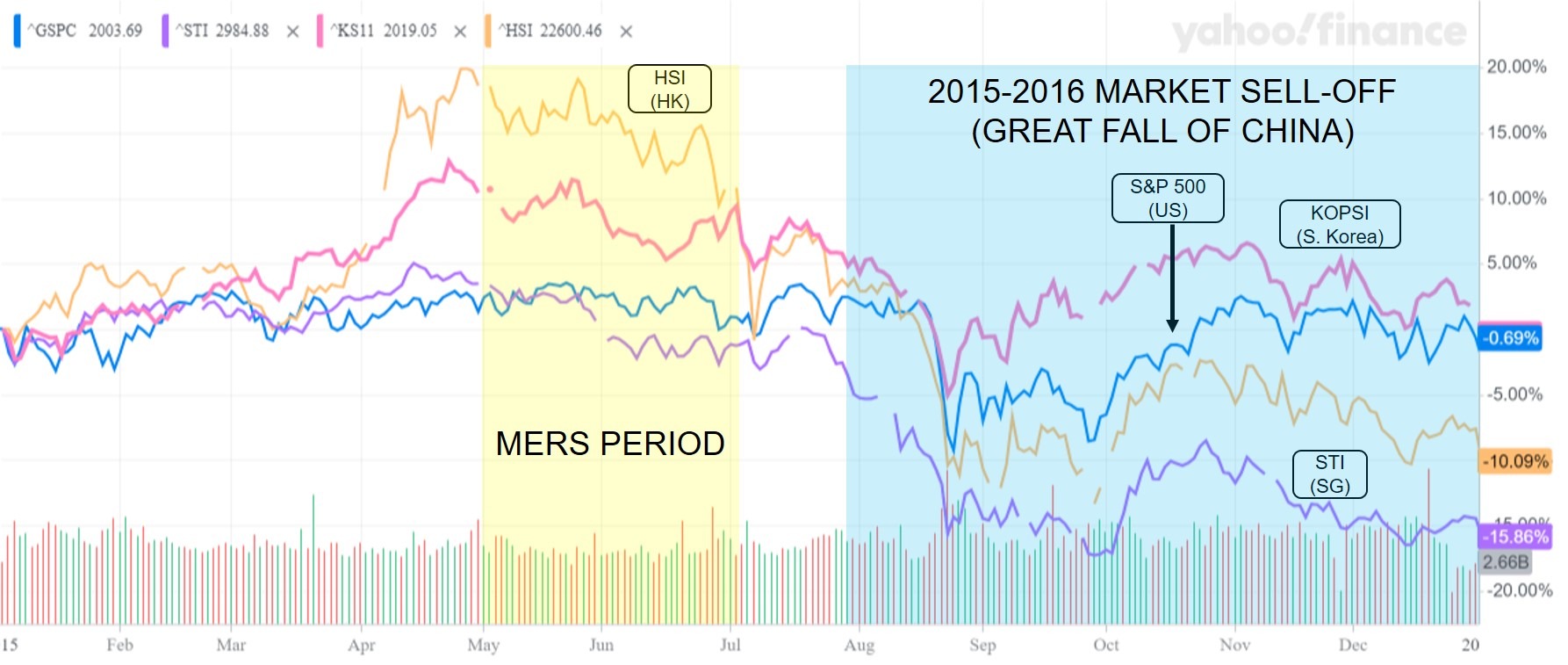

How did stocks perform during MERS?

By comparison, the Middle East respiratory syndrome coronavirus or MERS-CoV is a more recent outbreak where the first identified case occurred in 2012, Saudi Arabia.

A large outbreak occurred subsequently in South Korea from May 2015 to July 2015 with 186 cases and 38 deaths.

- Yet, there are no significant movements in the stock indexes (S&P 500, KOSPI, HSI, STI) during this period.

- Instead, significant declines, as much as 16

- The drastic fall is speculated to correlate with the 2015-2016 Chinese stock market turbulence with the SSE Composite Index crashing by more than 40

- Other reasons cited include the slowdown in China’s GDP growth, drop in oil prices, Greek debt default, end of quantitative easing in US, sharp rise in bond yields and Brexit.

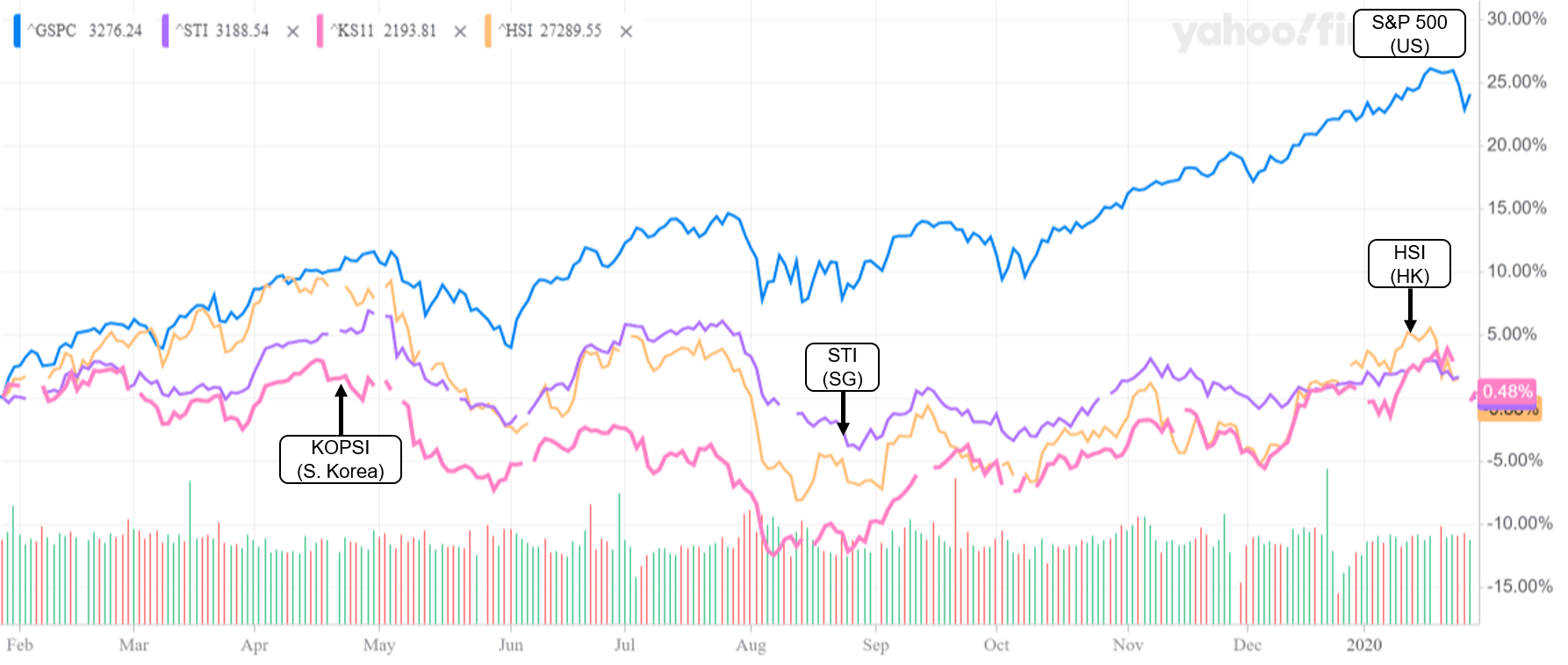

How are stocks impacted due to Wuhan virus?

- The stock indexes (S&P 500, KOSPI, HSI, STI) are down between 3-5

- It remains to be seen if the virus will have a sustained negative impact on the economy.

Should you invest?

For now, I wouldn’t.

The drop in stock indexes for SARS and MERS were not as straightforward as they seem as there were confluences of other significant economic events.

I’m holding back doing any investment until a meaningful decline is observed.

What about you?

Any content is intended to be used and must be used for informational purposes only. You should conduct your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on this Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.